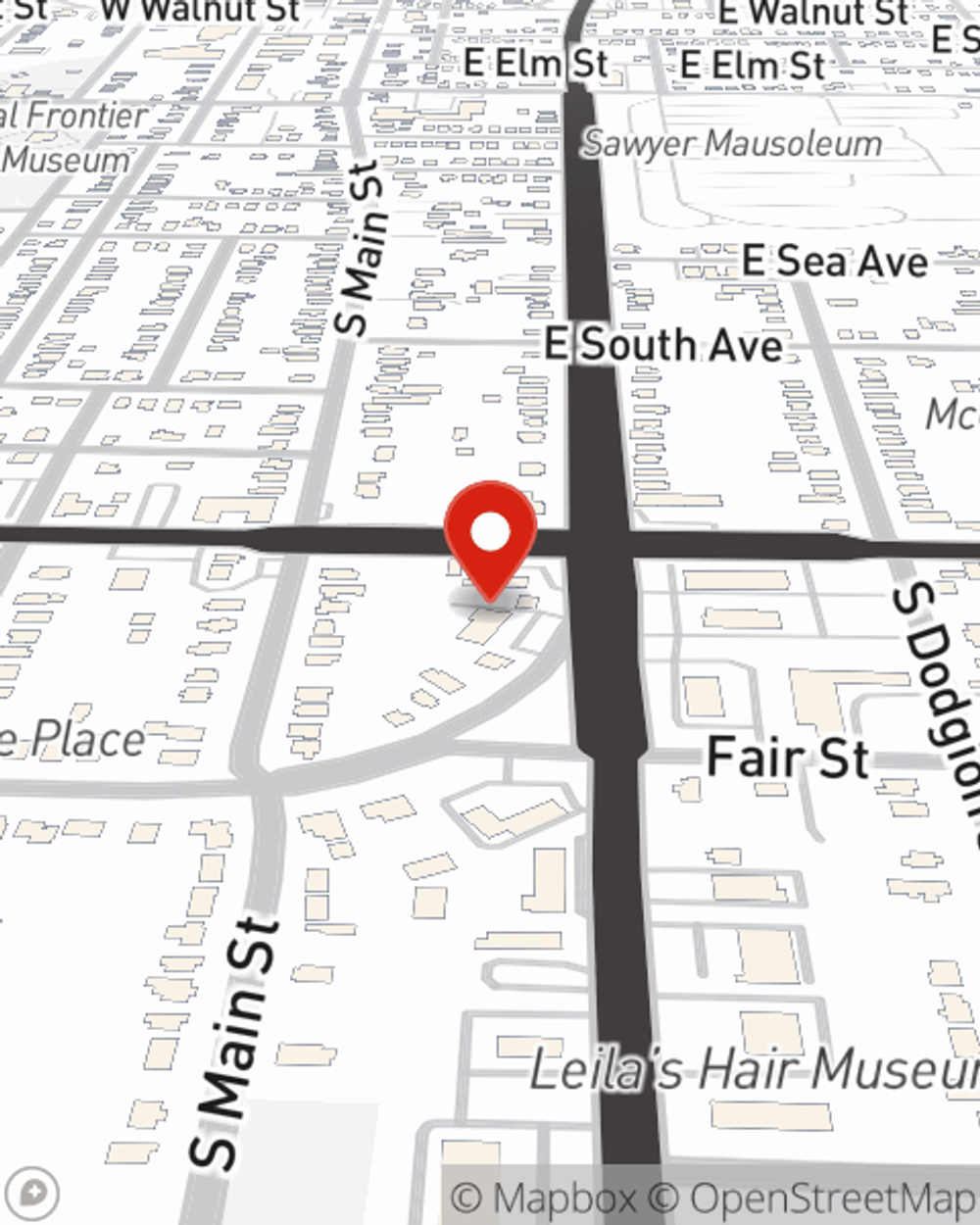

Life Insurance in and around Independence

State Farm can help insure you and your loved ones

What are you waiting for?

Would you like to create a personalized life quote?

- Lee's Summit

- Blue Springs

- Raytown

- Grandview

- Raymore

- Olathe

- Lenexa

- Overland Park

- Kansas City

- Shawnee

- Leawood

- Belton

- Liberty

- Gladstone

- Kearney

- Excelsior Springs

- Columbia

- Ashland

- sugar creek mo

Be There For Your Loved Ones

It can be what keeps you going every day to provide for your family, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that your partner can keep paying for your home and/or pay off debts as they mourn your loss.

State Farm can help insure you and your loved ones

What are you waiting for?

Independence Chooses Life Insurance From State Farm

Fortunately, State Farm offers various policy choices that can be personalized to fit the needs of those most important to you and their unique situation. Agent Lesley Siegfried has the personal attention and service you're looking for to help you choose a policy which can assist your loved ones in the wake of loss.

Simply visit State Farm agent Lesley Siegfried's office today to see how a company that processes nearly forty thousand claims each day can help cover your loved ones.

Have More Questions About Life Insurance?

Call Lesley at (816) 252-6882 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Lesley Siegfried

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.